What is employment status?

Employment status refers to the legal and working relationship a person has with an organization. It determines whether someone is an employee, a worker, or self-employed, and directly affects the rights, benefits, and obligations they’re entitled to under labor laws.

Summarise this post with:

This classification is essential for determining factors such as minimum wage eligibility, working hours, tax responsibilities, social security contributions, health benefits, and protection against unfair dismissal.

For example, full-time employees usually receive paid leave, job security, and employer contributions to health insurance or retirement plans, while freelancers or contractors may not.

Governments and courts look at various indicators to determine status, such as:

- The level of control the employer has over the individual,

- Mutual obligation between the two parties,

- Whether the work is personal or can be delegated, and

- Who bears financial risk in the relationship?

Understanding someone’s employment status isn’t just about job titles—it’s about how work is done, how much control is exercised, and how the relationship operates in practice.

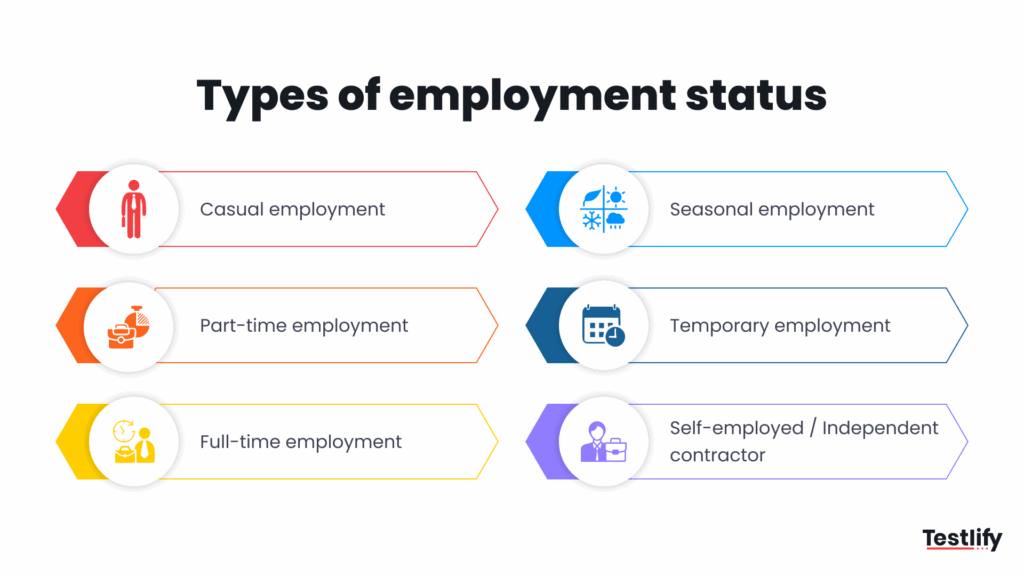

Types of employment status

When companies hire, they can offer different types of work arrangements depending on business needs and the nature of the job. Each type comes with its own level of security, flexibility, and benefits. Here’s a breakdown of the major employment statuses:

Casual employment

Casual employees work on an as-needed basis, without any guarantee of regular hours or long-term work. They’re usually paid per hour and often at a slightly higher rate since they don’t receive benefits like paid leave or job security.

Casual workers may not get consistent shifts, but they still have rights related to fair treatment, workplace safety, and anti-discrimination. However, the extent of these rights depends on local labor laws.

Part-time employment

Part-time roles involve working fewer hours than a full-time schedule, typically 34 hours or less per week. These positions are often paid hourly and may include limited benefits, depending on company policy and state or federal rules.

This arrangement suits students, caregivers, or those balancing other commitments, while also giving employers the flexibility to adjust staffing levels.

3. Full-time employment

Full-time employees generally work between 35 and 40 hours per week and often enjoy greater job stability. They are eligible for key benefits like paid time off, health insurance, retirement contributions, and sometimes bonuses.

Most full-time roles are governed by formal contracts and are considered the backbone of long-term workforce planning.

4. Seasonal employment

Seasonal workers are hired during specific times of the year, such as holiday retail, summer tourism, or agricultural harvests. Their contracts are temporary and aligned with peak business demand.

Although their tenure is short, seasonal employees are still entitled to protections such as minimum wage and safe working conditions.

5. Temporary employment

Temporary employees, also known as “temps,” are hired for a short duration to cover staff shortages, work on specific projects, or handle sudden spikes in workload. They can be hired directly or through staffing agencies.

While temporary roles provide quick job entry, benefits and rights vary by employer and may be limited compared to those of permanent staff.

6. Self-employed / Independent contractor

Independent contractors or freelancers work for themselves and provide services to businesses under specific contracts. They manage their own taxes, insurance, and retirement planning.

This status offers more freedom and control, but it also comes with the risk of inconsistent income and lack of employee benefits.

Employment status in the United States

In the U.S., employment status affects tax obligations, benefits, and labor rights. The IRS and Department of Labor assess whether someone is an employee or an independent contractor based on control, behavior, and financial relationship.

States may also have differing definitions, especially concerning gig workers. Correct classification protects both the employer and the worker from compliance risks.

Why does employment status matter?

Employment status affects:

- Pay and benefits: Determines eligibility for perks like health insurance and retirement plans.

- Tax obligations: Dictates whether employers withhold taxes or if individuals must pay self-employment taxes.

- Legal protections: Impacts rights like minimum wage, overtime pay, and wrongful termination protections.

- Workplace dynamics: Shapes the level of commitment and expectations between employers and workers.

What does inactive employee status mean?

Inactive employee status refers to individuals who are not currently working but remain tied to their employer. Common scenarios include:

- Extended leave: Employees on medical, parental, or unpaid leave.

- Suspension: Workers are temporarily removed from duties pending resolution of an issue.

Inactive employees may retain benefits depending on the organization’s policies.

What is casual employment status?

Casual employees work on an irregular or as needed basis, often without guaranteed hours. They typically lack access to the benefits and protections of full-time employment but enjoy flexibility. This status is common in industries like retail and hospitality.

Employment status outside of the US

Employment statuses vary globally. For example:

- United Kingdom: Employees, workers (a distinct category with fewer rights than employees), and self-employed individuals.

- Australia: Categories include permanent (full-time and part-time), casual, and contract workers.

- European Union: Employment contracts often define worker rights, with significant protections under EU labor laws.

Understanding local regulations ensures compliance and fair treatment for workers worldwide.

Chatgpt

Chatgpt Perplexity

Perplexity Gemini

Gemini Grok

Grok Claude

Claude